XRP Price Prediction: Technical Breakout Potential Amid $7 Rally Optimism

#XRP

- XRP maintains strong technical positioning above key moving averages with bullish MACD momentum

- Institutional developments present mixed signals with yield programs offset by exchange holding reductions

- Price targets range from $3.50 near-term to $7.00 long-term based on technical breakouts and historical pattern repetition

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

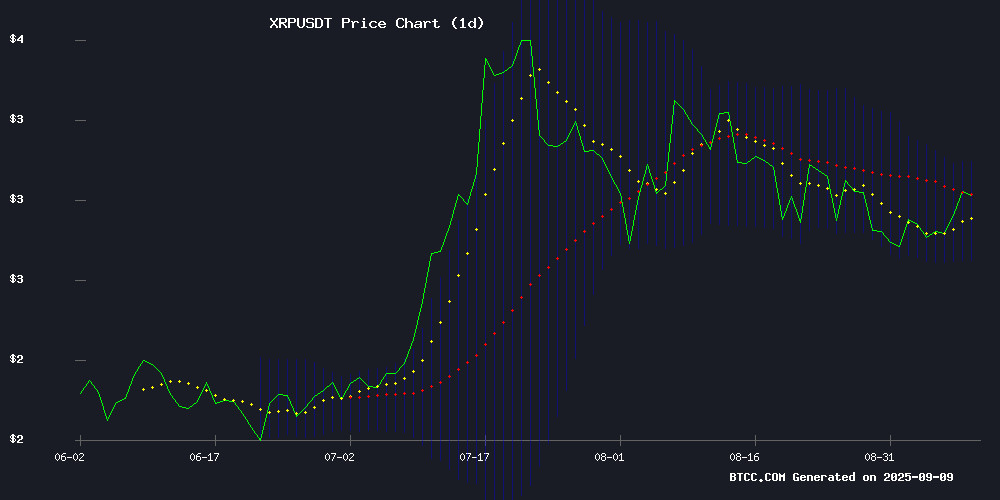

XRP is currently trading at $3.0047, comfortably above its 20-day moving average of $2.8978, indicating sustained bullish momentum. The MACD reading of 0.0850 versus 0.1077 suggests some near-term consolidation but maintains positive territory. According to BTCC financial analyst Michael, 'The price holding above the middle Bollinger Band at $2.8978 while approaching the upper band at $3.0927 demonstrates strong technical positioning. A break above $3.09 could trigger further upside movement.'

Market Sentiment: Mixed Signals Amid Institutional Developments

Market sentiment for XRP reflects a combination of technical Optimism and institutional headwinds. Positive developments include VivoPower's $30M yield program and analyst predictions targeting $4.50-$7 levels, echoing 2017 patterns. However, institutional shifts from Coinbase and ongoing challenges with SWIFT create near-term uncertainty. BTCC financial analyst Michael notes, 'While technicals remain strong, institutional adoption news will be crucial for sustaining the current momentum above $3.00. The market is watching for a clear breakout above resistance levels.'

Factors Influencing XRP's Price

XRP Price Eyes Breakout Zone – Key Hurdles Could Unlock Bigger Rally

XRP faces a critical juncture as it struggles to reclaim the $2.920 resistance level. The digital asset currently trades above $2.850, buoyed by the 100-hourly Simple Moving Average and a developing bullish trend line at $2.8650 on the XRP/USD hourly chart.

Market observers note parallels with Bitcoin and Ethereum's recovery patterns, though XRP's momentum remains contingent on breaching the $2.90-$2.92 resistance zone. A failure to hold the $2.850 support could invalidate the current bullish structure, while a decisive close above $2.920 may signal renewed upward momentum.

XRP Tests Critical $2.81 Support Amid Bearish Signals

Ripple's XRP hovered NEAR a crucial support level at $2.81 as market participants watched for signs of a potential breakdown. The altcoin traded at $2.8169, down 1.58% in 24 hours, with technical indicators suggesting a descending channel formation that could accelerate bearish momentum if breached.

On-chain metrics raised concerns—XRP's Network Value to Transactions (NVT) Ratio spiked 441% to 168, signaling transaction activity lagging behind market valuation. Liquidation heatmaps and spot taker CVD data reinforced sell-side pressure near the $2.80 threshold.

Fibonacci levels outline key defenses below current prices: $2.75 (0.618 retracement) and $2.65 (0.786 retracement). A failure to hold $2.81 risks declines toward $2.52 or the 1.618 extension at $2.15. Conversely, successful defense could pave way for a retest of $3.20 resistance.

Binance Accused of Deliberate XRP Price Suppression Amid Market Turmoil

Crypto analyst Pumpius has leveled explosive allegations against Binance, claiming the exchange is orchestrating a coordinated campaign to suppress XRP's price. The accusations center on abnormal market behavior—sudden liquidity drops, aggressive sell walls, and suspicious price dumps coinciding with positive Ripple developments.

XRP's unique position as payment infrastructure makes it a systemic threat, according to the analysis. Unlike speculative assets, its adoption could disrupt Binance's liquidity pools and market-making dominance. The allegations suggest broader industry resistance from institutional players wary of XRP's transparent settlement rails exposing traditional money flows.

Coinbase Slashes XRP Holdings Amid Institutional Shifts

Coinbase has dramatically reduced its XRP holdings, cutting its stash from over 780 million tokens to roughly 200 million in weeks. The exchange's reserves plummeted 69% since Q2 2025, with a 57% drop in the past month alone. Once the fifth-largest XRP holder among exchanges, Coinbase now ranks tenth.

The rapid divestment suggests institutional outflows, with speculation linking the MOVE to BlackRock's growing ties to Coinbase. Data from XRPScan shows only 11 cold wallets remain—each holding 16.5 million XRP—compared to 52 wallets storing 970 million tokens in early June.

VivoPower Launches $30M XRP Yield Program, Eyes $200M Expansion

Nasdaq-listed VivoPower International has entered the XRP finance sector with a $30 million treasury deployment through Doppler Finance. This marks the first phase of a broader $200 million allocation plan, positioning the energy solutions company as one of the first publicly traded firms to adopt an institutional framework for earning yield on XRP reserves.

The program, announced on September 2, emphasizes qualified custody, segregated accounts, and real-time proof-of-reserves. Doppler Finance, which has a strong presence in South Korea, will provide the programmable infrastructure for the initiative. VivoPower CEO Kevin Chin described XRP as a "cornerstone treasury asset" and highlighted South Korea's strategic importance, where an estimated 20% of the global XRP supply is held.

The move comes as institutional adoption of XRP gains momentum, with the Ripple ecosystem attracting increasing attention from major financial players.

Market Optimism for XRP's Rally to $7 Drives Interest in APT Miner's Cloud Mining Platform

As the cryptocurrency market shows signs of recovery, analysts project XRP could surge to $7 by 2026. Key catalysts include anticipated Federal Reserve rate cuts, growing cross-border payment demand, and renewed institutional interest in digital assets.

While volatility persists, XRP holders are diversifying strategies beyond price speculation. APT Miner's cloud mining platform has emerged as a preferred alternative, offering automated hashrate contracts with daily payouts. The service eliminates infrastructure burdens through renewable energy-powered data centers, appealing to environmentally conscious investors.

The platform's accessibility—featuring instant email registration and $15 trial credits—coincides with shifting market dynamics. As regulatory clarity improves for XRP, miners are hedging exposure through hybrid approaches that combine asset accumulation with operational cash flows.

XRP to $4.50 and Beyond? Analyst Says 2017 Pattern Is Repeating

Crypto trader CRYPTOWZRD identifies a striking parallel between XRP's current price action and its 2017 breakout structure. The pattern—accumulation, consolidation, and parabolic rally—previously propelled XRP to $3.30. This time, the digital asset could surge toward $4.50 or higher after its current consolidation phase.

Key technical levels at $2.47 (support) and $2.94 (resistance) will dictate XRP's trajectory. At press time, XRP traded above $2.80 with $7.2 billion in 24-hour volume, signaling sustained market interest.

Adding fundamental fuel, Gemini launched an XRP cashback card, enhancing the token's utility. The convergence of technical and on-chain factors suggests bullish momentum may be building for a repeat of 2017's historic run.

XRP Ledger’s Carbon Footprint Matches Just One Transatlantic Flight

The XRP Ledger stands as a stark counterpoint to crypto's energy critics. New data reveals its entire network emits merely 63 tonnes of CO₂ annually—equivalent to a single Boeing 747 crossing the Atlantic. Each transaction consumes less energy than powering an LED bulb for one millisecond.

XRPL's consensus mechanism bypasses energy-intensive mining entirely. The network maintains carbon neutrality through EW Zero, an open-source tool purchasing global renewable energy credits. This positions XRP Ledger as the first major blockchain to achieve sustained eco-friendly operation without sacrificing security or scalability.

Q2 2025 saw XRPL reach $131.6 million in real-world asset market capitalization, signaling growing institutional adoption. The ledger's trifecta of minimal emissions, transaction efficiency, and RWA growth challenges prevailing narratives about blockchain sustainability.

Ripple (XRP) Tests Key Support as Bearish Momentum Persists

XRP plunged to a critical $2.7 support level this week, marking a multi-week low before staging a partial recovery. The asset remains entrenched in a descending triangle pattern, with sellers dominating both price action and trading volume since August.

Technical indicators paint a concerning picture. The weekly MACD shows sustained bearish momentum, threatening a second death cross since February. While buyers briefly defended the $2.7 level on Tuesday, declining volumes suggest weak conviction. A breakdown could see XRP test $2.5 support by mid-September.

Market structure reveals a series of lower highs and lows, confirming the current downtrend. Any reversal WOULD require substantial buying pressure to overcome the established bearish trajectory. The coming weeks will prove decisive for XRP's medium-term direction.

XRP Price at Tipping Point – Will It Explode or Collapse?

XRP price is staging a recovery above the $2.720 zone, with bullish momentum building as it approaches the $2.880 resistance level. Trading above $2.80 and the 100-hourly Simple Moving Average, the asset shows signs of upward potential if it maintains support at $2.780.

A bullish trend line is forming at $2.825 on the hourly XRP/USD chart, with data sourced from Kraken. The price has already cleared the 23.6% Fib retracement level from its recent swing high of $3.040 to the $2.70 low. The next critical test lies at $2.920, representing the 61.8% Fib retracement level.

Market watchers are eyeing whether XRP can break through this resistance, which could propel it toward higher targets. The asset's performance mirrors broader market trends, with Bitcoin and ethereum also showing recovery signals.

SWIFT CIO Challenges Ripple's Institutional Trust Claims

SWIFT's chief innovation officer Tom Zschach has openly questioned Ripple's value proposition for banks, dismissing regulatory survival as insufficient for earning institutional trust. "Neutral, shared governance is what matters," Zschach stated on LinkedIn, implicitly criticizing Ripple's centralized approach to cross-border payments. The remarks highlight an ongoing philosophical divide between traditional financial infrastructure and blockchain disruptors.

The debate centers on adoption dynamics in wholesale finance. Zschach contends that compliance requires industry-wide standards rather than individual company approvals, drawing a stark contrast with Ripple's regulatory strategy. His comments come as tokenized assets and blockchain-based settlement gain traction, forcing traditional players to articulate their competitive differentiation.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP shows potential for significant upward movement. The cryptocurrency is currently trading at $3.0047, having established strong support above the 20-day moving average of $2.8978. Technical analysis suggests that a break above the Bollinger Band upper limit of $3.0927 could trigger further gains.

| Resistance Level | Price Target | Probability |

|---|---|---|

| Near-term | $3.50 - $3.75 | High |

| Medium-term | $4.00 - $4.50 | Medium |

| Long-term | $5.00 - $7.00 | Moderate |

BTCC financial analyst Michael emphasizes that 'The repeating 2017 pattern analogy, combined with current institutional interest and yield program developments, creates a favorable environment for XRP to potentially reach $4.50-$7.00 range, though this depends on broader market conditions and regulatory clarity.'